Navigating the Volatile Rate Increase of 2022

Interest rates have risen since the holidays, making this a good time to connect and plan with your Mortgage Banker (especially if you’ve already been prequalified!). Here’s some background on what’s going on and what to expect with your homebuying journey in 2022.

Why have rates risen so quickly?

- Interest rates are determined by the market —specifically, what actions the Federal Reserve is taking.

- The Federal Reserve forced interest rates down to help our economy through the pandemic.

- Now, the Federal Reserve has changed course, so interest rates across all types of borrowing are resetting back to pre-pandemic levels. This feels like a big shift when compared to rates we’ve gotten used to over the past couple of years — but there are plenty of ways to work with your Mortgage Banker and mitigate the increase.

How can I prepare?

- First, it’s important to adjust expectations. Mortgage interest rates have changed significantly since the holidays, and it may be frustrating to see them climb — but this should be factored into what you anticipate when buying a home now.

- Now is not the time to give up or wait. Sente Mortgage is actively watching all the market fluctuations and is here to help guide you. Your Sente Mortgage Banker is well-equipped, ready and able to help you navigate these rate increases.

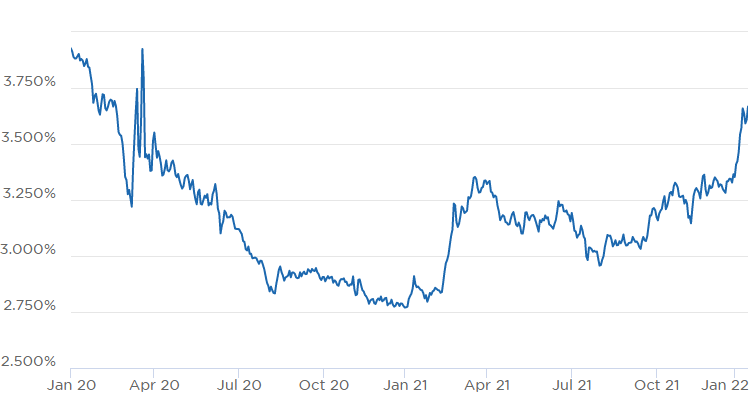

Interest rates across all borrowing are going up as a result of the Federal Reserve’s actions to offset the historically high inflations we are experiencing. Here’s a chart displaying changes in interest rates for 30-year fixed mortgage since January 2020. While interest rates feel very high right now, we are reverting back to pre-pandemic rates.