Budget for Deductibles

During the mortgage process, most people become hyper-aware of the impact of unexpected expenses. Take, for example, insurance deductibles. When a life event happens that requires insurance to kick in, there is often a deductible that you pay out of pocket — which could mean thousands of dollars annually.

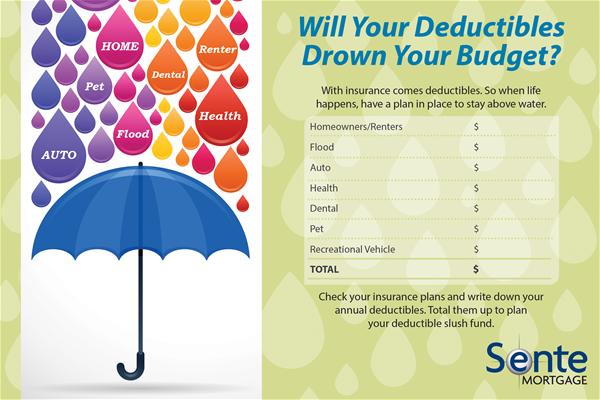

A practice we’ve recently learned about is to create a deductible slush fund. This is a separate savings account where you stash away enough to cover at least 20% of your total yearly insurance deductibles — as a cushion against these large unexpected expenses. To find out how much to budget, use this chart below to list your deductibles, add them up and multiply by 20%. That’s the amount you should plan to save.

Now you can decide how much time you’ll take to save up this slush fund. Two years is a good target. If you divide your total by 24, you’ll know how much you need to save monthly for two years in order to reach your goal. During that time, if a deductible needs to be paid, you’ll already have some cash on hand to help cover it. Once it’s fully funded, you’ll need to keep your slush fund current.

Nobody likes to think about the possibility of bad things happening, but with a deductible slush fund, you’ll have more peace of mind.

Looking for more budgeting tools? Check out our Budget Planner Calculator.