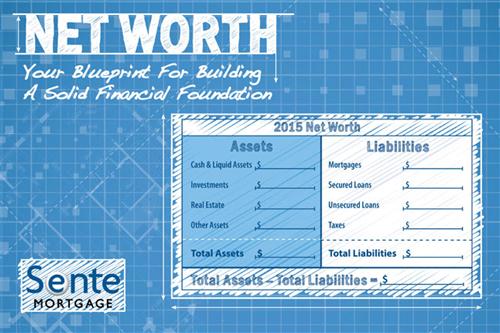

Net Worth

If you’re planning changes to your home, its original blueprint is invaluable. Similarly, as you evaluate changes to your financial strategies, your net worth calculation can serve as a blueprint. Remember, net worth is total assets minus total liabilities – what you own minus what you owe.

Assets may be broken down into categories:

- Cash & Liquid Assets: Current checking and savings account balances, CDs, and Money Market accounts.

- Investments: Treasury bills, bonds, mutual funds, stocks and options, as well as retirement savings in 401k, IRAs, and pensions.

- Real Estate: Market value of your primary residence as well as vacation and investment properties.

- Other: Value of private businesses, life insurance, trust funds, vehicles, art, collectibles, and jewelry.

A good rule of thumb is to include anything equaling $500 or more in value.

Liabilities may also be broken out into categories:

- Mortgages: Balances on primary, vacation, and investment properties.

- Secured Loans: Balances on auto, recreational vehicle, and business loans.

- Unsecured Loans: All credit card and student loan balances, personal and renovation loans, cash advances, and medical bills.

- Taxes: Property and annual income taxes due.

Understanding your net worth gives you a quick survey of your financial health. Done annually, it’s a tracking tool to help assess your financial moves over time. If you would like our detailed net worth spreadsheet, please download it here.