CPAs and Financial Planners

Making sure your financial plan is in good shape is more than just keeping up with your bills and ensuring your credit report is accurate (though both of these are important!) Your overall plan also benefits from the involvement of a group of specialists. These experts make sure your risks are covered (insurance agent), your property value and financing are in order (real estate agent and mortgage banker), and your family is taken care of (attorney).

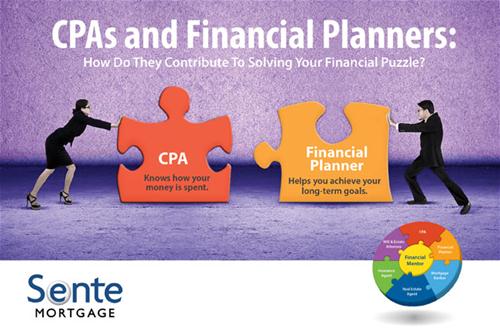

In addition, there are a couple of financial generalists (CPA and financial planner) you’ll also want on your team. Because they deal with your overall financial picture, some think their roles are interchangeable. But they’re really quite different: a CPA focuses on what has gotten you to the present while a financial planner focuses on getting you to your future goals.

Think of your CPA as your expert in all things tax related. She not only helps you file your taxes but also works to ensure the accuracy of your return, minimizing your risk for an audit and maximizing your return. In addition, you can rely on her to keep you informed of the latest tax laws and make recommendations to help lower your tax liability.

Your financial planner, on the other hand, is there to help you grow your wealth. Financial planners review your current financial standing and, based on your financial goals, develop an investment and financial strategy to help you accumulate wealth.

More than ever, you may require help because of the complexity of our financial plans. If you need help in building your team, I’d be happy to connect you with professionals I trust.