Understanding VA Loans and Residual Income

VA loans are approved in much the same manner as any other loan program. A lender (like Sente Mortgage) reviews the veterans’ credit, documents…

Read MorePay Off Debt or Save for Retirement?

There’s an age-old dilemma: Do you pay down debt or save for retirement with your excess dollars? Paying down debt can be appealing–it feels…

Read MoreTexas Mortgage Refinancing Made Simple

4 Things to Consider if you’re Looking to Refinance Your Mortgage Over the last couple of months we’ve had several past clients, friends, and…

Read MoreSavings Buckets

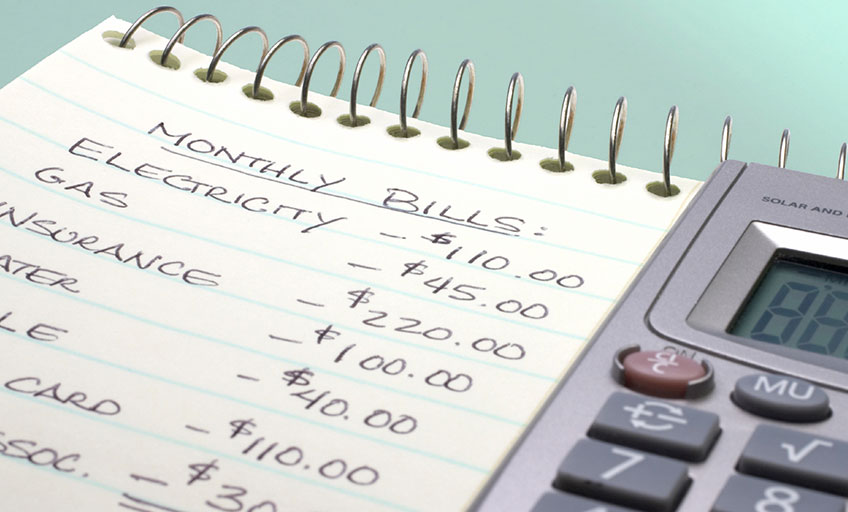

A recent survey revealed that more than 75% of Americans don’t have enough money saved to cover their bills for six months. Half have…

Read MoreTime to ReFi?

When Sente Mortgage was founded in October 2007, the average rate on a 30-year fixed-rate mortgage was over 6.25%. Since then, things have changed…

Read MoreSolving Your Financial Puzzle

The financial world is more complicated than ever before. Having a team in place that can contribute their expertise and that understands your personal…

Read MoreFocus on the New Retirement

We tend to visualize retirement based on the experience of our parents and grandparents. The reality is, however, that our retirement will look a…

Read MoreHow to Get Your Certificate of Eligibility

The VA home loan program is part of the original GI Bill prepared by Congress in 1944 to help returning soldiers more quickly assimilate…

Read MoreTake a Financial Day

Between work, school, family, and life, leaving our financial business to the weekend may mean it doesn’t all get done. Or, if we do…

Read More