Did You Miss Refinancing This Past Year?

New Affordable Refinance Option Could Help Millions of Americans Lower Mortgage Payments

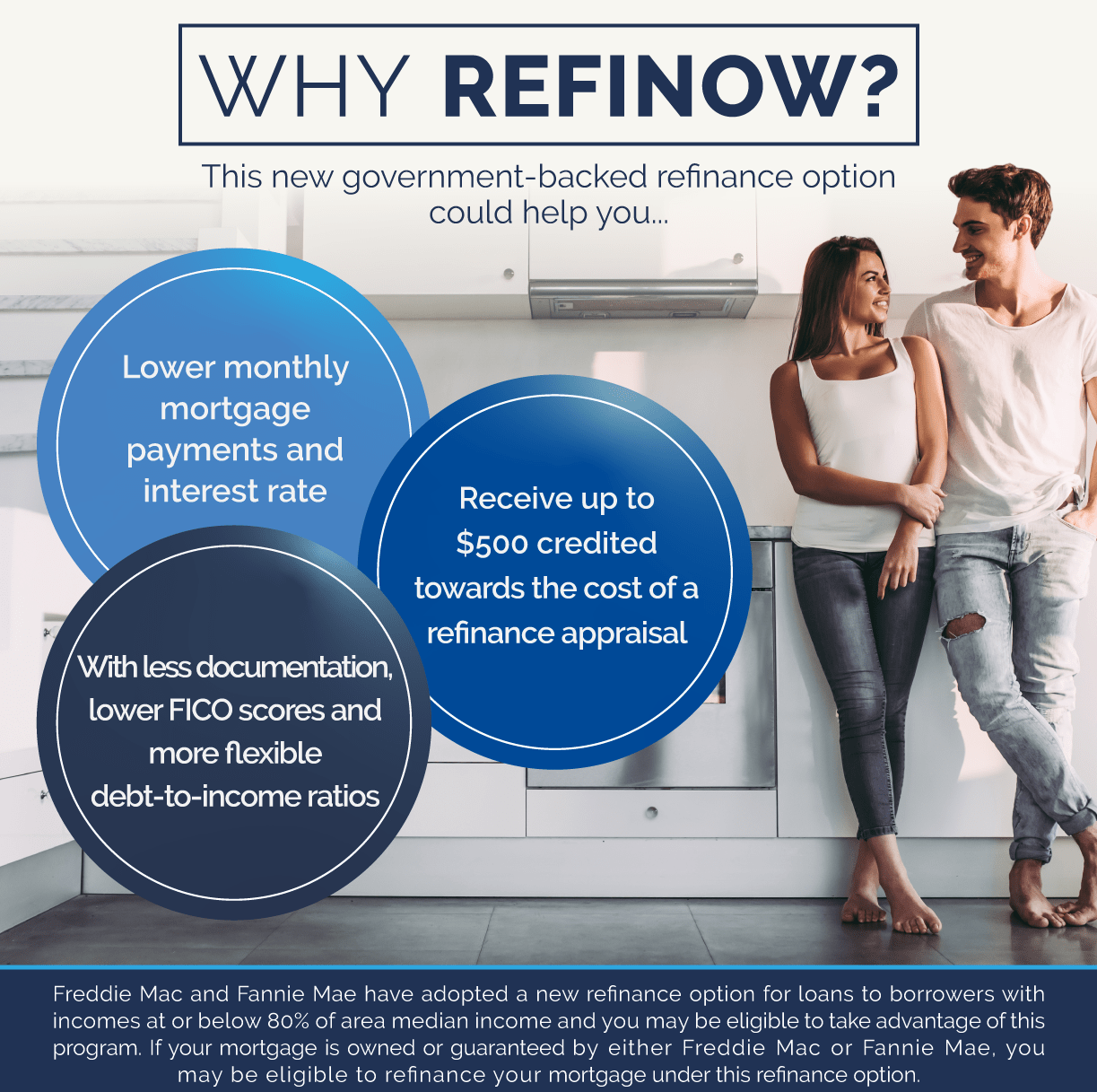

The Federal Housing Finance Association (FHFA) launched an exciting new refinance option this summer for borrowers who have been unable to take advantage of the historically low mortgage interest rates over the past year. Specifically aimed at borrowers who are at or below 80% of their area’s median income, RefiNow™ could help an estimated 2 million borrowers save $1,200 to $3,000 a year on their mortgage payments. Freddie Mac will also be rolling out its similar option, RefiPossible™.

Sente’s purpose is straightforward: we exist to create financial possibility. We strive to help homeowners stay in their homes and make the best financial decisions for their future. This new refinance option could be a powerful lever for borrowers who have struggled through the pandemic or have otherwise not been able to refinance.

You can determine whether your mortgage is owned by either Freddie Mac or Fannie Mae by checking the following websites:

While RefiNow™ could open the door to refinancing for borrowers across the country, it’s important to note that there are a number of eligibility requirements. To see if RefiNow™ can work for you or someone you know, contact us today to speak with a qualified Mortgage Banker.