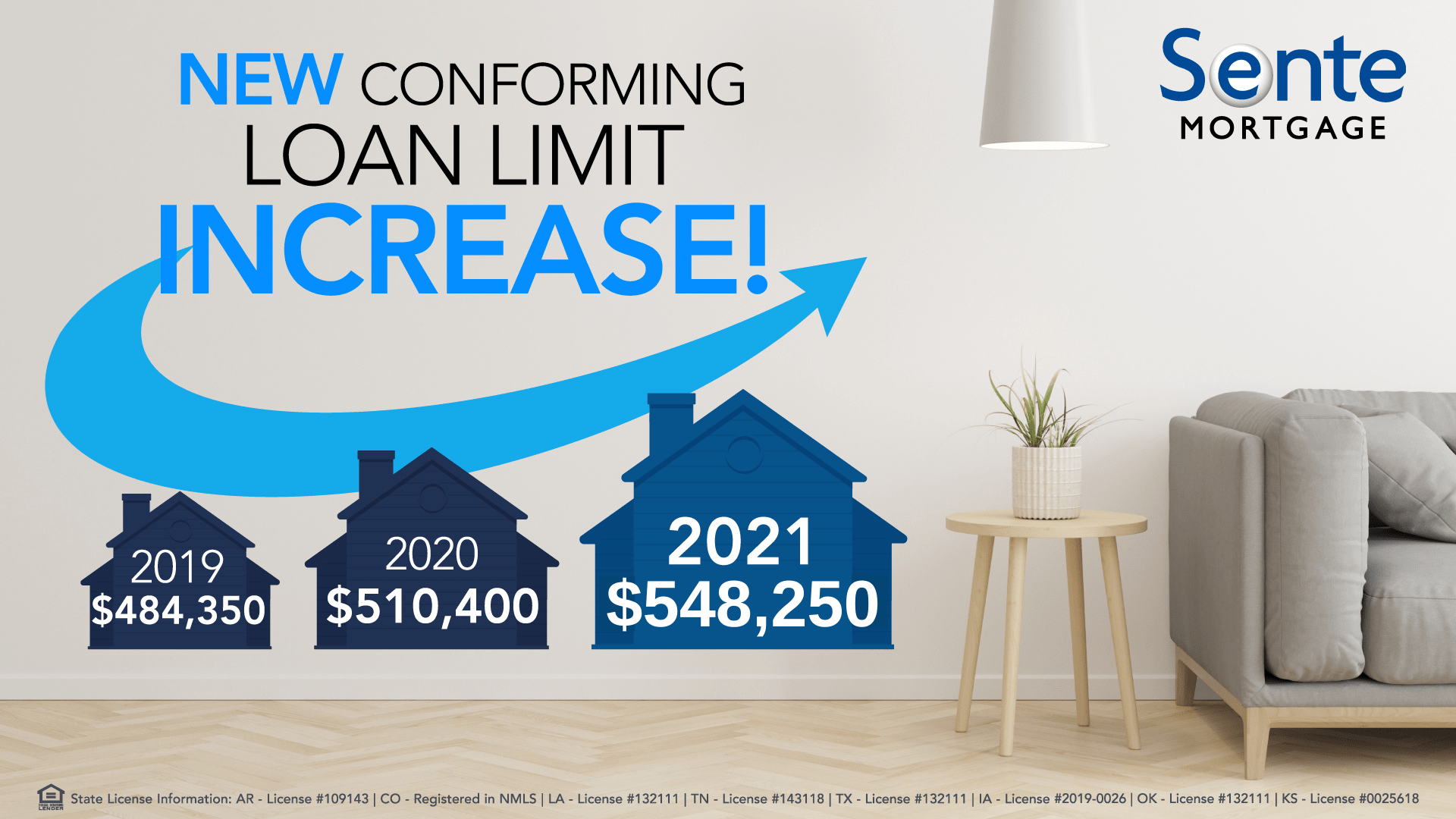

New Conforming Loan Limits Set at $548,250 for 2021

What Does This Mean for You?

The Federal Housing Finance Committee (FHFA) just announced that in 2021, new limits for conforming loans will be set at $548,250 for most of the country, up from $510,000 in 2020. What does this mean for borrowers? You’ll have more buying power.

The FHFA oversees Fannie Mae and Freddie Mac; these entities are responsible for regulating mortgages (which includes setting the limits on home loans that conform to Fannie and Freddie criteria — known as “conforming home loans”). These limits are adjusted annually to account for changes in the average U.S. home price.

Conforming loans are seen as some of the most user-friendly for borrowers. Starting in 2021, these loans will be available for mortgages up to $548,250, which means you might be able to put less money down or purchase a bigger house without having to get what’s called a “Jumbo Loan” or a high-balance loan. Jumbo and high-balance loans tend to have stricter income underwriting, higher rates for smaller down payments, and specific requirements for the cash a borrower has in reserve. They can also take longer to close than conventional loans.

This will mark the 5th straight year of Fannie and Freddie raising mortgage loan limits — a stark contrast to the decade between 2006-2016 when this ceiling went unchanged. Increasing conforming loan limits is yet another indicator that home prices in the U.S. continue to be on the rise.