Out of Sight, Out of Mind

Too often unplanned events can derail a family’s finances. For example, by not reviewing your estate plan every few years, your assets could be distributed to unintended recipients.

In talking with experts in estate and financial planning, they shared with me some insights that may help protect your assets and ensure your wishes are realized.

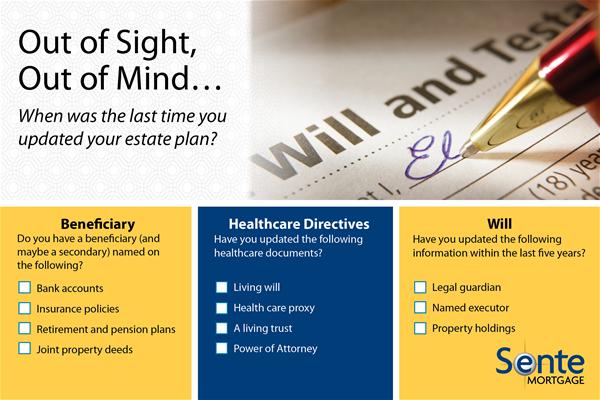

- Beneficiary – Regardless of the instructions in your will, the beneficiary named on your retirement accounts determines who actually receives your money. It’s imperative that when you have a major life change, such as a marriage or birth of a child, you update your beneficiary information.

- Wills – By creating a will and specifying how the taxes are paid on your assets, you can ensure your heirs don’t get saddled with estate taxes and other expenses. You can specify that those costs be paid from your estate. Also, it is a best practice to update your will at least every five years.

- Healthcare Directives – In order to maintain control of your well-being and assets while you are still alive, there are certain documents that should be prepared. A living will outlines your wishes if you become terminally ill. A health care proxy names an individual responsible for making medical decisions if you cannot. And a living trust and power of attorney ensure you or someone you trust maintains control should you become unable.