Portfolio Out of Balance?

The stock market has been volatile, but even so the Dow Jones average has increased substantially from its low below 7,000 in February of 2009. As the year comes to a close, it’s a great time to reflect on the market fluctuations of the past 12 months, and what effect they may have had on your investments.

Many of us have investments in the market, either directly or indirectly through 401ks, IRAs, or other retirement portfolios. Our assets are divided among various categories, including classes of stocks (large vs. small), bonds and REITs to name a few. How your money is allocated among these asset classes defines your potential risk and return.

Because these assets increase and decrease in value differently over time, you may find you have an asset allocation out of sync with your investment objectives. This can create a situation where you are exposed to more risk than you want.

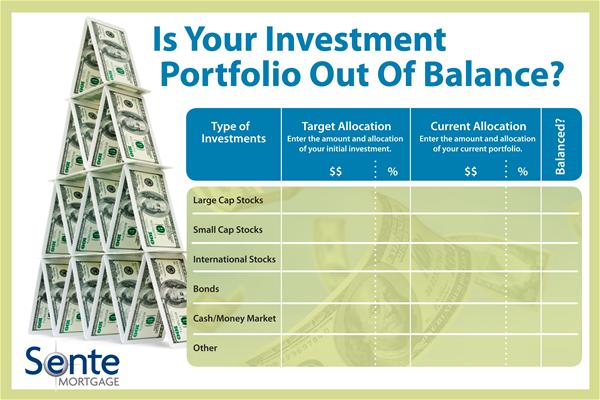

It is generally a good idea to re-balance your allocations annually and the table included above is a good start. Of course, be sure to touch base with your financial advisor to make sure your investments reflect your long term goals. If you would like an introduction to an advisor we trust, please let us know.