Saving for Retirement (If You Didn’t Start Early)

When it comes to saving for retirement, the drumbeat of advice focuses on starting early, socking away around 15% of your income, and letting compound interest go to work for you. But what if that advice didn’t really hit home in time for you to get that jump start, or you just weren’t able to prioritize saving earlier on? Currently, only about 43% of American workers participate in a retirement savings plan — so where do you begin if you’re feeling behind?

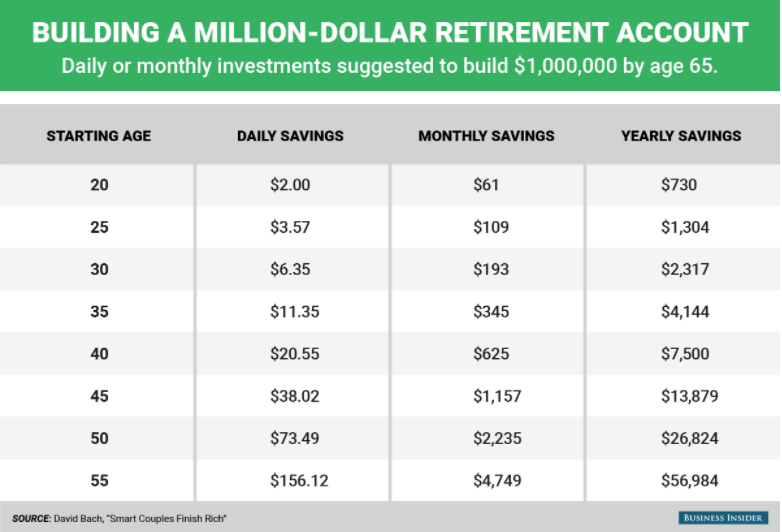

To make up for lost ground, it’s first helpful to understand why experts emphasize starting early. The earlier you start saving, the more time you’ll have to accumulate returns — to leverage the benefits of compounding interest. Compounding interest means that you are reinvesting the gains on an investment from previous years into future years. Importantly, compounding interest makes growth exponential, not linear. To visualize this, let’s look at this chart inspired by David Bach’s book “Smart Couples Finish Rich.”

Here’s another way at exploring the benefits of compounding. As MarketWatch shares, if a 25-year-old put $10,000 in a stock index fund and added $500 a month until age 65, he or she would end up with $2.34 million. The 9% long-term historical average annual gain for U.S. stocks would compound over four decades, despite the fact that only a total of $250,000 was added to the fund in that span.

If you start saving for retirement later in life, we see from above how much more has to be saved to reach the same end goal. But that doesn’t mean it’s impossible. You just need to see the whole picture, be honest with your starting point and desires, and be aware of the options available to you. If you’re past the point of “starting early,” here are some tips on how to best prepare yourself, financially, for retirement.

If Offered a 401(k) — Fully Fund It

This is one of the most powerful retirement savings tools available to you. Here’s an example from Investopedia that shows just how meaningful maxing out contributions to your retirement savings plan can be:

An individual who is 40 years old and who contributes $17,500 annually to a 401(k) could accumulate more than $1.3 million in savings by age 65. This assumes an 8% return and no employer contributions. If this individual increases savings by a catch-up amount of $5,500 at age 50, this would lead to an additional $271,000 in savings.

Make Use of Catch-Up Contributions

For those saving for retirement after the age of 50, retirement plans offer special benefits to help maximize your contributions during your remaining working years. For example, the annual contribution limit for 401(k)s is $19,500 per year for 2020 and 2021. But for those who have a 401(k) and are over 50 years old, you can defer an extra $6,500 to your 401(k) from your salary in 2021. This means that people over 50 can bump their total contributions to $26K per year, which then churns out greater savings thanks to compounding interest.

There are different limits for other plans, such as SIMPLE 401(k)s and IRAs (which allow for an extra $1,000 on top of the standard $5,500 in monthly contribution maximums). Another trick is to increase your contribution rate with each pay raise. The more money you make, the more you should save.

Don’t Bank on Working Indefinitely

A whopping 53% of workers currently plan to stay in the workforce beyond the age of 65, according to Transamerica Center for Retirement Studies. Many Boomers have decided they want to keep working, or they have to, or they need to work to maximize social security checks. But don’t let this mindset keep you from having a retirement savings safety net. You need a back-up plan — because only 1 in 5 Americans over the age of 65 are employed. Your plans to work into your later years can be thwarted by a number of unexpected factors, so don’t corner yourself into a precarious position.

Know the Basic Goals By Decade

Whether you’re starting early in your 20s or racing to the finish in your 50s, different targets and strategies will apply. For example: in your 20s, focus should generally be on establishing consistent income, living within a budget, and aiming to save the equivalent of your annual salary or consistently putting away 15% of your pay. Fast forward to your 40s, and your strategies shift to maximizing personal contributions to retirement accounts, aiming to have saved 4-6x your annual salary, or doubling down on making catch-up contributions.

Click the image below for an article from CNBC that breaks down decade-by-decade advice:

Get Expert Help

Any retirement savings advice that’s available on the internet or social media will be generic. The goals will be generalized milestones; the strategies will likely lack some depth. This is why we tout the benefits of investing in a relationship with a financial advisor.

Your family situation, money habits, lifestyle, and vision of the future are all unique. To ensure that you’re able to set yourself up for the future you desire, we recommend partnering with a financial advisor that can see your whole financial picture and work with you to customize your milestones, strategies and tactics. Need a recommendation? Your Sente Mortgage Banker has you covered.