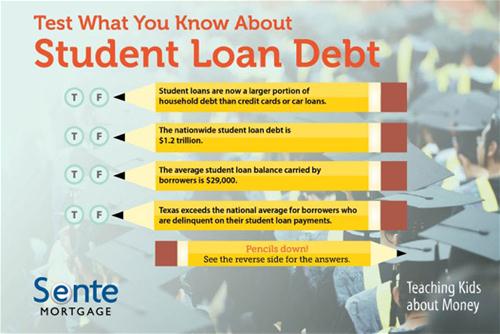

Student Loan Debt Quiz

True or False:

- Student loans are now a larger portion of household debt than credit cards or car loans.

- The nationwide student loan debt is $1.2 trillion.

- The average student loan balance carried by borrowers is $29,000.

- Texas exceeds the national average for borrowers who are delinquent on their student loan payments.

Pencils down! See below for the answers.

Would it surprise you to know that all of the answers above are true? Student loan debt is an issue that potentially concerns us all, in part because taxpayers are liable if federal student loans go unpaid. In addition, excessive debt at the beginning of adulthood could stunt our consumer-driven economy. We are seeing many millennials delay making larger-ticket purchases, like cars and homes, due in part to their student debts.

Below are ideas to help minimize the impact of student debt.

- Open a 529 account savings plan as early as possible. These plans offer significant tax advantages, high contribution limits, and investment flexibility. Additionally, the savings in a 529 will have a lower impact on the availability of other financial aid.

- Tap into the Free Application for Federal Student Aid (FAFSA) website. This, and similar websites that provide information about grants and scholarships, should be visited as early as possible to identify sources of aid that don’t require repayment.

- If loans are required, shop around. Not all student loans are created equal. Some have higher interest, more rigid repayment requirements, and even the potential to be forgiven. Talk to a financial aid advisor if you have questions.

- After graduation, consider consolidating student loans. For federal loans, you can get consolidation information at studentaid.ed.gov. For private loans, you will need to talk with your lender.

In addition, if you want to do more planning, check out the student loan calculators at finaid.org.